American Finance Association – Office of President

The following statements of formal duties are provided in the Bylaws for The American Finance Association

Section 2. President. The President shall be the principal executive officer and shall perform all duties incident to the office of president and such other duties as may be provided by the Board of Directors. The President shall be elected for a one-year term by the members. The nominee of the Nominating Committee shall be the current President-Elect. Space shall be provided on the ballot for write-in votes, which shall be counted. The results of the election shall be certified and announced by the Executive Secretary and Treasurer at the annual meeting.

Section 3. President-Elect. The President-Elect shall serve for a one-year term and in the following year shall be the only nominee of the Nominating Committee for President. He or she shall have included in his or her duties the function of the Chair of the Program Committee with the responsibility of appointing the committee members and such other tasks as may be assigned by the President. The sole nominee of the Nominating Committee for this office shall be the current Vice President. Space shall be provided on the ballot for write-in votes, which shall be counted. The nominee and space for write-in votes shall appear on the same ballot as the election of the President, provided in Article V, Section 2. The results of the election shall be certified and announced by the Executive Secretary and Treasurer at the annual meeting.

Most of this list was compiled by the AFA Historian, Stephen Buser.

| Name | Year Served |

|---|---|

| Monika Piazzesi, Stanford University | 2024 |

| Markus Brunnermeier, Princeton University | 2023 |

| Laura Starks, University of Texas at Austin | 2022 |

| John Graham, Duke University | 2021 |

| Kenneth Singleton, Stanford University | 2020 |

| David Hirshleifer, University of California, Irvine | 2019 |

| Peter DeMarzo, Stanford University | 2018 |

| David Scharfstein, Harvard University | 2017 |

| Campbell Harvey, Duke University | 2016 |

| Patrick Bolton, Columbia University | 2015 |

| Luigi Zingales, University of Chicago | 2014 |

| Robert Stambaugh, University of Pennsylvania | 2013 |

| Sheridan Titman, University of Texas at Austin | 2012 |

| Raghuram Rajan, University of Chicago | 2011 |

| John H. Cochrane, University of Chicago | 2010 |

| Darrell Duffie, Stanford University | 2009 |

| Jeremy C. Stein, Harvard University | 2008 |

| Kenneth R. French, Dartmouth College | 2007 |

| Richard C. Green, Carnegie Mellon University | 2006 |

| John Y. Campbell, Harvard University | 2005 |

| René Stulz, Ohio State University | 2004 |

| Douglas W. Diamond, University of Chicago | 2003 |

| Maureen O’Hara, Cornell University | 2002 |

| George M. Constantinides, University of Chicago | 2001 |

| Franklin Allen, University of Pennsylvania | 2000 |

| Hans R. Stoll, Vanderbilt University | 1999 |

| Edwin J. Elton, New York University | 1998 |

| Hayne E. Leland, University of California, Berkeley | 1997 |

| Eduardo S. Schwartz, University of California, Los Angeles | 1996 |

| Martin J. Gruber, New York University | 1995 |

| Sanford J. Grossman, University of Pennsylvania | 1994 |

| Mark E. Rubinstein, University of California, Berkeley | 1993 |

| Michael C. Jensen, Harvard University | 1992 |

| Robert H. Litzenberger, University of Pennsylvania | 1991 |

| Myron S. Scholes, Stanford University | 1990 |

| Michael J. Brennan, University of California, Los Angeles | 1989 |

| Stephen A. Ross, Yale University | 1988 |

| Richard Roll, University of California, Los Angeles | 1987 |

| Robert Merton, Massachusetts Institute of Technology | 1986 |

| Fischer Black, Goldman Sachs & Company | 1985 |

| James C. Van Horne, Stanford University | 1984 |

| Stewart Myers, Massachusetts Institute of Technology | 1983 |

| Harry Markowitz, IBM Corporation | 1982 |

| Franco Modigliani, Massachusetts Institute of Technology | 1981 |

| William F. Sharpe, Stanford University | 1980 |

| Edward Kane, Ohio State University | 1979 |

| Burton Malkiel, Princeton University | 1978 |

| Alexander A. Robichek, Stanford University | 1977 |

| Merton H. Miller, University of Chicago | 1976 |

| Myron J. Gordon, University of Toronto | 1975 |

| John Lintner, Harvard University | 1974 |

| Sherman Maisel, University of California, Berkeley | 1973 |

| Irwin Friend, University of Pennsylvania | 1972 |

| Joseph Pechman, Brookings Institute | 1971 |

| Lawrence S. Ritter, New York University | 1970 |

| Walter E. Hoadley, Bank of America | 1969 |

| Harry C. Sauvain, Indiana University | 1968 |

| Robert V. Roosa, Brown Brothers Harriman & Company | 1967 |

| J. Fred Weston, University of California, Los Angeles | 1966 |

| George Garvy, Federal Reserve Bank of New York | 1965 |

| Roger F. Murray, Columbia University | 1964 |

| George T. Conklin, Jr., Guardian Life Ins. Co. of America | 1963 |

| Bion B. Howard, Northwestern University | 1962 |

| Arthur M. Weimer, Indiana University | 1961 |

| Paul M. Van Arsdell, University of Illinois | 1960 |

| James J. O’Leary, Life Insurance Association of America | 1959 |

| Lester V. Chandler, Princeton University | 1958 |

| Marshall D. Ketchum, University of Chicago | 1957 |

| Miller Upton, Beloit College | 1956 |

| Norris O. Johnson, First National City Bank of New York | 1955 |

| Garfield V. Cox, University of Chicago | 1954 |

| Roland I. Robinson, Northwestern University | 1953 |

| Edward E. Edwards, Indiana University | 1952 |

| Raymond J. Saulnier, National Bureau of Economic Research | 1951 |

| Howard R. Bowen, University of Illinois | 1950 |

| Neil H. Jacoby, University of California, Los Angeles | 1949 |

| Benjamin H. Beckhart, Columbia University | 1948 |

| Lewis A. Froman, Russell Sage College | 1947 |

| Harry G. Guthmann, Northwestern University | 1946 |

| Inactive | 1945 |

| Inactive | 1944 |

| John D. Clark, University of Nebraska | 1943 |

| Charles L. Prather, University of Texas | 1942 |

| Chelcie C. Bosland, Brown University | 1941 |

| Kenneth Field, Carnegie Institute of Technology | 1940 |

Past Presidents of the American Finance Association from 1940-Present

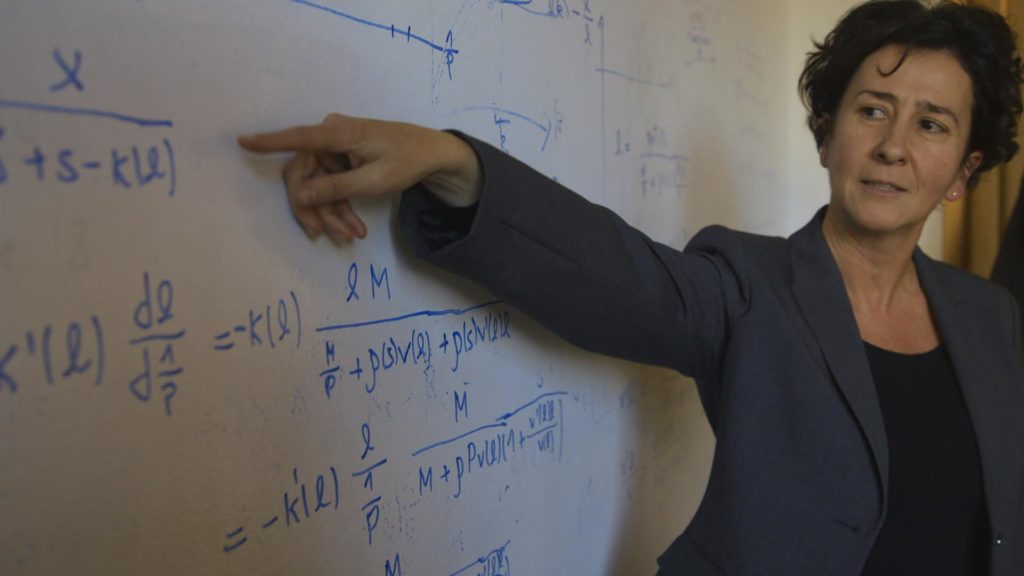

Monika Piazzesi (2025)

Monika Piazzesi is the Joan Kenney Professor of Economics at Stanford University and a senior fellow at the Stanford Institute for Economic Policy Research. She earned her Ph.D. in economics from Stanford in 2000 and has held faculty positions at UCLA, the University of Chicago Booth School of Business, and Stanford, which she joined in 2008.

Her research focuses on asset pricing, macroeconomics, and time series econometrics, with particular emphasis on bond markets, housing, bank risk, and monetary policy. She has published influential work on the term structure of interest rates and continues to explore topics such as Taylor rules and the yield curve.

Piazzesi has received numerous honors, including the Germán Bernácer Prize (2005), the Elaine Bennett Research Prize (2006), and election to the National Academy of Sciences (2023). She directed the NBER Asset Pricing Program from 2007 to 2019 and has also held editorial roles with leading journals including the Journal of Political Economy, American Economic Review, and Economic Journal.

Markus Brunnermeier (2023)

Markus K. Brunnermeier is the Edwards S. Sanford Professor at Princeton University and Director of the Bendheim Center for Finance. Markus is known for his expertise in international financial markets, monetary theory, and macroeconomics.

His academic achievements include a PhD from the London School of Economics and a Doctor honoris causa from the University of Regensburg. Brunnermeier has authored award-winning books such as “A Crash Course on Crises”, “The Resilient Society”, and “The Euro and the Battle of Ideas”.

Brunnermeier is a member of several advisory groups, and he is a nonresident senior fellow at the Peterson Institute, a Sloan Research Fellow, fellow of the Econometric Society, Guggenheim Fellow, a research associate at the National Bureau of Economic Research, the Centre for Economic Policy Research, CESifo, ABFER, and a member of the Bellagio Group on the International Economy. He is also the recipient of the Bernácer Prize granted for outstanding contributions in the fields of macroeconomics and finance.

Laura Starks (2022)

Laura T. Starks, Ph.D., is the George Kozmetsky Centennial University Distinguished Chair at the McCombs School of Business, University of Texas at Austin, where she teaches graduate and undergraduate courses on environmental, social and governance investing. Her current research focuses on ESG issues, including climate finance and board diversity, as well as molecular genetics and financial decisions. She has won many awards for her research and teaching. She is Research Associate of the NBER, Research Member for the ECGI, and Senior Fellow for ABFER. She has served as President of the Society of Financial Studies, Western Finance Association and Financial Management Association, and is a Past President of the American Finance Association. She is Editor of the FMA Survey and Synthesis Series, Advisory Editor for the Financial Analysts Journal and Financial Management and previously, Editor of the Review of Financial Studies. She has served or currently serves on mutual funds’ boards of directors, pension fund advisory committees, the Board of Governors of the Investment Company Institute, and the Governing Council of the Independent Directors Council, and advisory committees for the Norwegian Government Pension Fund.

John Graham (2021)

Dr. Graham is the D. Richard Mead professor of finance at the Fuqua School of Business at Duke University. His past work experience includes teaching at the University of Utah and seven years working as a senior economist at Virgina Power. He has been co-editor of the Journal of Finance, associate editor of The Journal of Finance, The Review of Financial Studies, Finance Research Letters, and Financial Management, and has served on the board of directors of the American Finance Association, the Western Finance Association, and the Financial Management Association, three of the largest academic finance professional organizations. Graham is currently President-elect of the Financial Management Association and has been President of the Western Finance Association, is a Fellow of the Financial Management Association, and is a research associate of the National Bureau of Economic Research. He is multiple time winner of best teacher awards and also a recipient of the overall Outstanding Faculty award. Graham has served as area coordinator of Duke’s finance group and as co-director of the Duke Center for Financial Excellence.

Graham has published more than 50 articles and book chapters on corporate taxes, cost of capital, capital structure, financial reporting, and payout policy. His research has won numerous best paper awards. His teaching focuses on corporate finance, taxes, mergers and acquisitions, and corporate restructuring. His simulated corporate marginal tax rates are widely used and are an important input in the Duff and Phelps cost of capital publications.

Since 1997 Graham has been the director of the Global Business Outlook (http://www.cfosurvey.org), a quarterly CFO survey that assesses the business climate and topical economic issues around the world. He appears regularly in the media to discuss the survey and corporate sector. Finally, Graham is lead author on the textbooks Corporate Finance: Linking Theory to What Companies Do (Cengage) and Introduction to Corporate Finance (Cengage).

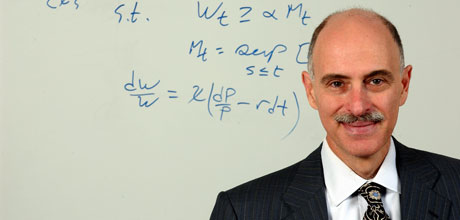

Kenneth Singleton (2020)

Kenneth Singleton is the Adams Distinguished Professor of Management, Emeritus at the Graduate School of Business at Stanford University. Professor Singleton’s research interests are in econometric methods for estimation and testing of dynamic asset pricing models; modeling of term structures of government and defaultable bond yields; measuring and managing market, credit and liquidity risks; and debt financing in emerging economies. He has been awarded the Smith-Breeden Prize (Journal of Finance), Frisch Medal (Econometrica), and the Stephen A. Ross Prize in Financial Economics (Foundation for the Advancement of Research in Financial Economics), and he is a Fellow of the Econometric Society, the Journal of Econometrics, and the Society for Financial Econometrics.

Ken is the Co-Founder and President of the Board of the 501(c)3 nonprofit 1 Grain to 1000 Grains that leads programs for families in low-income communities to create positive lifestyle changes by discovering intuitive and actionable plans for more healthful eating and for building financial capacity. Ken received a BA in Mathematics from Reed College and a PhD in Economics from the University of Wisconsin-Madison.

David Hirshleifer (2019)

David Hirshleifer is a Professor of Finance at The Paul Merage School of Business since 2006 and currently holds the Merage chair in Business Growth at the University of California at Irvine. Hirshleifer served as President of the American Finance Association in 2019. He was also assigned as Research Associate to National Bureau of Economic Research.

Hirshleifer was previously a professor at the University of Michigan, Ohio State University, and University of California, Los Angeles. His research is mostly related to behavioral finance and informational cascades. Due to his extensive research he was on the Top 100 list of most cited economist in Economics and Business. Some of his research areas include the modeling of social influence, theoretical and empirical asset pricing, and corporate finance. An extensive part of his work is on investor psychology and has focused on the effects on biased self-attribution, overconfidence, and limited attention. He and his colleagues were recognized and awarded the 1999 Smith Breeden Award for research showing how investor overconfidence, in combination with biased self-attribution, can explain the short-run momentum and long-run reversal patterns found the returns on many stock markets.

Peter M. DeMarzo (2018)

Peter M. DeMarzo is the Staehelin Family Professor of Finance, and faculty director for Educational Technology at Stanford University Business School. DeMarzo was appointed president of the American Finance Association for the 2019 term.

Professor DeMarzo received his B.A. in Cognitive Science and Applied Mathematics at the University of California, San Diego in 1984. He later continued his education and received a M.S. in Operations Research in 1985 and a Ph.D. in Economics in 1989. He began teaching at the Kellog School of Management in 1989 and Northwestern University and remained there until 1997. However, between 1995 and 1997 he was a visiting assistant professor at Stanford, after which he secured an associate professorship at the Haas School of Business of the University of California, Berkeley. He has published research on corporate investment and financing, asset securitization, financial contracting, and market regulation. Recent work has examined the optimal design of securities, compensation mechanisms, regulation of insider trading and broker-dealers, bank capital regulation, and the influence of information asymmetries on corporate disclosures and investment. He is co-author of Corporate Finance and Fundamentals of Corporate Finance (Pearson Prentice Hall 2012). He is a Research Associate of the National Bureau of Economic Research. His research has received awards including the Barclays Global Investors/Michael Brennan best paper award from the Review of Financial Studies, and the Western Finance Association Corporate Finance Award. He won the Sloan Teaching Excellence award in 2004 and 2006, and the Cheit Outstanding Teaching Award in 1998.

David S. Scharfstein (2017)

David S. Scharfstein is the Edmund Cogswell Converse Professor of Finance and Banking at Harvard Business School, also serving as Senior Associate Dean. He served as President of the American Finance Association in 2017.

Professor Scharfstein began his college career at Princeton University where he received his A.B. in 1982, and his Ph.D. in economics from MIT in 1986. After completing his education, he went to join Harvard Business School in 1986 as an Assistant Professor of Business Management, following the Sloan School of Management at MIT as an Assistant Professor of Finance in 1987. A couple of year after he was promoted to Associate Professor in 1990, and to Dai-Ichi Kanygo Bank Professor of Management and Professor of Finance, in 1994. Scharfstein has published on a broad range of topics in finance, including corporate investment and financing behavior, risk management, financial distress, capital allocation, and venture capital. His current research focuses on financial intermediation and financial regulation, including research on housing finance, financial system risk, bank lending and funding, and the growth of the financial sector. Scharfstein is currently a research associate of the National Bureau of Economic Research. He has also published 37 peer-reviewed articles on various aspects of capital management, and written working papers and 11 Harvard Business School Cases.

Campbell R. Harvey is Professor of Finance at the Fuqua School of Business, Duke University and a Research Associate of the National Bureau of Economic Research in Cambridge, Massachusetts. He served as President of the American Finance Association in 2016.

Professor Harvey obtained his doctorate at the University of Chicago in business finance. He has served on the faculties of the Stockholm School of Economics, the Helsinki School of Economics, and the Booth School of Business at the University of Chicago. He has also been a visiting scholar at the Board of Governors of the Federal Reserve System. He was awarded an honorary doctorate from Svenska Handelshögskolan in Helsinki. He is a Fellow of the American Finance Association.

Harvey has received three Jensen prizes for the best corporate finance paper in the Journal of Financial Economics, two Notable Contribution awards from the American Accounting Association for the best accounting paper published in any journal over the past five years, an Amundi Smith-Breeden distinguished paper, seven Graham and Dodd Awards/Scrolls for excellence in financial writing from the CFA Institute, and the 2016 and 2015 Best Paper Awards from The Journal of Portfolio Management. He has published over 125 scholarly articles on topics spanning investment finance, emerging markets, corporate finance, behavioral finance, financial econometrics, financial accounting and computer science.

Harvey is a Founding Director of the Duke-CFO Survey. This widely watched quarterly survey polls over 1,500 CFOs worldwide.

Harvey edited The Journal of Finance – the leading scientific journal in his field and one of the premier journals in the economic profession from 2006-2012.

His publications can be found at http://people.duke.edu/~charvey/research.htm

Follow him on Twitter @camharvey

Sources of information for Campbell Harvey

https://en.wikipedia.org/wiki/Campbell_Harvey

Patrick Bolton holds a B.A. in economics from the University of Cambridge and a B.A. in political science from the Institut d’Etudes Politiques de Paris. He served in the French army from 1979-1980. Then in 1986, he received his Ph.D. from the London School of Economics.

Dr. Bolton began his academic career as an assistant professor at the University of California at Berkeley. In 1987, he accepted a position with Harvard University’s economics department and continued his professorship there until 1989. Additional academic appointments include the following: Chargé de Recherche at the C.N.R.S. Laboratoire d’ Econométrie de L’ Ecole Polytechnique, from 1989-1991; Cassel Professor of Money and Banking at the London School of Economics, from 1991-1994; Chargé de cours associé at the Institut d’Etudes Europénnes de l’Université Libre de Bruxelles, from 1994-1998; and John H. Scully ’66 Professor of Finance and Economics at Princeton University, from 1998-2005.

In 2005, Professor Bolton joined the faculty of Columbia University and has since become the David Zalaznick Professor of Business at the Business School. His research and areas of interest are in contract theory and contracting issues in corporate finance and industrial organization. His work focuses on the allocation of control and decision rights to contracting parties when long-term contracts are incomplete. This issue is relevant in many different contracting areas, including the firm’s choice of optimal debt structure, corporate governance and the firm’s optimal ownership structure, vertical integration, and constitution design. Dr. Bolton’s work in industrial organization focuses on antitrust economics and the potential anticompetitive effects of various contracting practices.

Professor Bolton recently published his first book, Contract Theory, with Mathias Dewatripont and has co-edited a second book with Howard Rosenthal, Credit Markets, for the Poor. Dr. Bolton was elected to serve as president of the America Finance Association for 2015.

Sources of information for Patrick Bolton

http://www4.gsb.columbia.edu/cbs-directory/detail/586132/Patrick+Bolton

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Columbia Business School website

Luigi Zingales was born in Padua, Italy, where the high inflation and unemployment rate gave inspiration to him to become an economist and implement changes within the financial system. Dr. Zingales obtained a bachelor’s degree in economics (summa cum laude) from Universita Bocconi in Italy in 1987, and then completed a Ph.D. in economics from the Massachusetts Institute of Technology in 1992. Following graduation, he joined the faculty at the University of Chicago’s Booth School of Business, where he is currently the Robert C. McCormack Professor of Entrepreneurship and Finance and the David G. Booth Faculty Fellow.

Professor Zingales’s research interests include corporate governance, financial development, political economy, and the economic effects of culture. Currently, he is working on developing optimal interventions to cope with the aftermath of the financial crisis. He also co-developed the Trust Fund Index. Dr. Zingales is the co-author, with Raghuram G. Rajan , of Saving Capitalism from the Capitalists (2003) and A Capitalism for the People: Recapturing the Lost Genius of American Prosperity (2012). In the latter book, Dr. Zingales suggests that “channeling populist anger can reinvigorate the power of competition and reverse the movement toward a ‘crony system.’”

Dr. Zingales serves as a member of the committee on Capital Markets Regulation. He is also a faculty research fellow at the National Bureau of Economic Research, a research fellow for the Center for Economic Policy Research, and a fellow of the European Governance Institute. He is currently an editor for II Sole 24 Ore.

In 2003, Dr. Zingales was the winner of the Germán Bernácer Prize, which is awarded to the best European economist under 40 working in macro-finance. In 2012, Dr. Zingales was a participant in the ‘No-Brainer Economic Platform’ project of NPR’s program Planet Money. He advocated a six-part reform plan that involved eliminating all American income, corporate, and payroll taxes as well as the war on drugs and replacing the system with a broad consumption tax (including taxing formerly illegal substances). In 2012, he was named by Foreign Policy magazine one of the Top 100 Global Thinkers, “For reminding us what conservative economics used to look like.”

Sources of information for Luigi G. Zingales

http://en.wikipedia.org/wiki/Luigi_Zingales

http://www.chicagobooth.edu/faculty/directory/z/luigi-zingales

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the nanocivis website

Robert Stambaugh received his B.A. from Dickinson College in 1974, cum laude, with honors in economics and a second concentration in mathematics. He then continued his studies to earn his MBA in 1976, and then his Ph.D. in 1981 in finance and econometrics, both from the University of Chicago. While he was completing his graduate work, Dr. Stambaugh secured a position with Ford Motor Company, as a financial analyst, where he worked from 1976–1977. Prior to joining the Wharton School of the University of Pennsylvania in 1988, he was a professor of finance at the University of Chicago. Professor Stambaugh also served as a visiting professor at Harvard University as a Marvin Bower Fellow from 1997-1998.

Currently, Dr. Stambaugh is the Miller Anderson & Sherrerd Professor of Finance at the Wharton School of the University of Pennsylvania. He is also a fellow of the Financial Management Association, and a research associate of the National Bureau of Economic Research.

Professor Stambaugh has served as the editor of the Journal of Finance, an editor of the Review of Financial Studies, an associate editor of those journals as well as the Journal of Financial Economics, and a member of the first editorial committee of the Annual Review of Financial Economics. His research focuses on empirical asset pricing, and he often uses Bayesian analysis in his papers. Dr. Stambaugh has published numerous articles on topics such as return predictability, asset pricing tests, portfolio choice, parameter uncertainty, liquidity risk, volatility, performance evaluation, investor sentiment, and active-versus-passive investing. His research awards include a Smith-Breeden first prize for an article in the Journal of Finance as well as three Fama-DFA second prizes for articles in the Journal of Financial Economics.

Sources of information for Robert Stambaugh

https://fnce.wharton.upenn.edu/profile/985/

http://en.wikipedia.org/wiki/Robert_F._Stambaugh

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Wharton Club of Northern California website

Sheridan Titman received a B.S. from the University of Colorado, Boulder, in 1975, an M.S. from Carnegie Mellon University in 1978, and a Ph.D. from Carnegie Mellon University in 1981. He has been affiliated with the University of Texas at Austin since 1997.

Professor Titman is currently the Walter W. McAllister Centennial Chair in Financial Services, Department of Finance at UT Austin. Prior to joining the UT Austin faculty, Dr. Titman worked at Boston College; Hong Kong University of Science & Technology, where he was one of the founding professors of the School of Business and Management; and the University of California Los Angeles, where he served as chair of the Department of Finance and vice chairman of the UCLA management school faculty. Dr. Titman is also currently the director of the Energy Management and Innovation Center at UT Austin.

Professor Titman is well known for his research on finance and real estate topics, as well as corporate governance. He is currently a research associate of the National Bureau of Economic Research. Dr. Titman has served on the editorial boards of leading academic journals, including the Journal of Finance and the Review of Financial Studies. Dr. Titman won the Smith-Breeden Prize for the best finance research paper published in the Journal of Finance, the GSAM best paper award for the Review of Finance, and was a recipient of the Batterymarch Fellowship. He has also co-authored three finance textbooks, Financial Markets and Corporate Strategy Valuation: The Art and Science of Corporate Investment Decisions, and Financial Management: Principles and Applications.

Dr. Titman was an academic advisor to the registered investment advisory firm, Gerstein Fisher. In the 1988-89, academic year, he worked in Washington D. C. as the special assistant to the Treasury Assistant Secretary for Economic Policy. In 2012, is also a former president of the Western Finance Association.

Sources of information for Sheridan Titman

http://acsprod.mccombs.utexas.edu/FEG/index.asp?uid=57

http://www.mccombs.utexas.edu/directory/profiles/titman-sheridan

http://en.wikipedia.org/wiki/Sheridan_Titman

http://www.nber.org/people/sheridan_titman

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Reit website

Raghuram Rajan graduated from the Indian Institute of Technology, Delhi with a bachelor’s degree in electrical engineering in 1985, after which he acquired a postgraduate diploma in business administration from the Indian Institute of Management Ahmedabad in 1987. He received a Ph.D. in management from the Massachusetts Institute of Technology in 1991.

After completing his doctorate, Professor Rajan joined the Booth School of Business at the University of Chicago, where he is the Eric J. Gleacher Distinguished Service Professor of Finance there. Dr. Rajan is currently on leave from the U of C, assuming charge as the Governor of the Reserve Bank of India since September 2013.

Dr. Rajan’s research interests span the topics of banking, corporate finance, and economic development. His papers have been published in top economics and finance journals, and he has served on the editorial board of the American Economic Review and the Journal of Finance. He has written a book with Luigi Zingales entitled Saving Capitalism from the Capitalists. He then wrote Fault Lines: How Hidden Fractures Still Threaten the World Economy, and was awarded the Financial Times-Goldman Sachs prize for best business book in 2010. In January 2003, the American Finance Association awarded Dr. Rajan the inaugural Fischer Black Prize, given every two years to the financial economist under age 40 who has made the most significant contribution to the theory and practice of finance.

Dr. Rajan has held many administrative positions throughout his career. From 2003-2006, he was the chief economist at the International Monetary Fund. In 2008, Indian Prime Minister Dr. Manmohan Singh appointed Dr. Rajan as an honorary economic adviser. In 2012, he was appointed as Chief Economic Adviser to the Government of India. In 2013, it was announced that Dr. Rajan would take over as the RBI Governor, and serve for a term of three years. He has also chaired the Indian government’s Committee on Financial Sector Reforms. Dr. Rajan is currently a member of the American Academy of Arts and Sciences.

Sources of information for Raghuram G. Rajan

http://www.chicagobooth.edu/faculty/bio.aspx?person_id=12825569280

http://en.wikipedia.org/wiki/Raghuram_Rajan

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the General Knowledge Today website

John Cochrane received a B.A. in physics from the Massachusetts Institute of Technology and earned his Ph.D. in economics at the University of California at Berkley. He was hired by the economics department at the University of Chicago prior to joining the Booth School in 1994 and is currently the AQR Capital Management Professor there. From 2000-01, he was also a visiting professor at the University of California Los Angeles Anderson School of Management.

The central theme of Professor Cochrane’s research is that macroeconomics and finance should be linked. A theory needs to explain how, given the observed prices and financial returns, households and firms decide on consumption, investment, and financing; and how, in equilibrium, prices and financial returns are determined by households and firms decisions.

Professor Cochrane’s recent financial publications include the book, Asset Pricing, and articles on dynamics in stock and bond markets, the volatility of exchange rates, the term structure of interest rates, the returns to venture capital, liquidity premiums in stock prices, the relation between stock prices and business cycles, and option pricing when investors can’t perfectly hedge. His publications in the field of economics include articles on the relations between deficits and inflation, the effects of monetary policy, and on the fiscal theory of the price level. Additional research topics of interest have included macroeconomics, health insurance and time-series econometrics.

Dr. Cochrane has served as a research associate for the National Bureau of Economic, a fellow of the Econometric Society, and an adjunct scholar of the CATO institute. Past positions include editor of the Journal of Political Economy and associate editor of Journal of Monetary Economics, Journal of Business, and Journal of Economic Dynamics and Control. Dr. Cochrane’s recent awards include the TIAA-CREF Institute Paul A. Samuelson Award, for his book Asset Pricing; the Chookaszian Endowed Risk Management Prize; and the Faculty Excellence Award for MBA teaching.

Sources of information for John H. Cochrane

http://faculty.chicagobooth.edu/john.cochrane/research/papers/cochrane_bio.pdf

http://en.wikipedia.org/wiki/John_H._Cochrane

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Chicago Booth Faculty website

Darrell Duffie received his B.Sc.E. from the University of New Brunswick in 1975. He then earned his M.Ec. from the University of New England in 1980. In 1984, he obtained his Ph.D. from Stanford University, and subsequently was hired as a member of the finance faculty there. He is currently the Dean Witter Distinguished Professor of Finance at The Graduate School of Business at Stanford.

Professor Duffie’s research interests include over-the-counter markets, banking, financial risk management, credit risk, valuation and hedging of derivative securities, term structure of interest rate modeling, financial innovation, and market design. His most recent research focuses on asset pricing, credit risk, fixed-income securities, and over-the-counter markets.

Dr. Duffie is interested in how capital moves from one segment of asset markets to another, and the implications of imperfect trading opportunities for asset price behavior. He and several of his colleagues have obtained recent results on portfolio credit risk, based on the assumption that there are unobservable common default-risk factors. Duffie’s recent books include How Big Banks Fail (Princeton University Press, 2010), Measuring Corporate Default Risk (Oxford University Press, 2011), and Dark Markets (Princeton University Press, 2012).

Dr. Duffie is currently a fellow and member of the Council of the Econometric Society, a research associate of the National Bureau of Economic Research, a fellow of The American Academy of Arts and Sciences, as well as the 2003 IAFE/Sunguard Financial Engineer of the Year. He is also a member of the Financial Advisory Roundtable of the Federal Reserve Bank of New York, and a member of the board of directors of Moodys Corporation (since 2008). Dr. Duffie currently chairs the Market Participants Group, charged by the Financial Stability Board with recommending reforms to Libor, Euribor, and other interest rate benchmarks.

Sources of information for J. Darrell Duffie

http://www.gsb.stanford.edu/users/duffie

http://en.wikipedia.org/wiki/Darrell_Duffie

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph credit Asia Kepka

Jeremy Stein received his A.B. in economics from Princeton University (summa cum laude) in 1983 and his Ph.D. in economics from the Massachusetts Institute of Technology in 1986. Since May of 2012, Dr. Stein has served as a member of the Board of Governors of the Federal Reserve System. Prior to joining the board, Dr. Stein began his academic career as an assistant professor of finance at the Harvard Business School in 1987, and remained there until 1990. He then joined the finance faculty at M.I.T.’s Sloan School of Management for ten years, later receiving the honor of J.C. Penney Professor of Management. He returned to Harvard in 2000, where he taught courses in finance in the undergraduate and Ph.D. programs. He is currently the Moise Y. Safra Professor of Economics there.

Dr. Stein’s research spans a wide range of topics that include behavioral finance and stock-market efficiency, corporate investment and financing decisions, risk management, capital allocation inside firms, banking, financial regulation, and monetary policy. In 2002, he received the Fama-FDA prize for his paper “Breadth of Ownership and Stock Returns” (with Joseph Chen and Harrison Hong). This annual prize is awarded to authors who produce the best capital markets and asset pricing research papers published in the Journal of Finance Economics.

Dr. Stein has served on the editorial boards of several prominent economic and finance journals, including the Journal of Finance, the American Economic Review, the Journal of Financial Economics, the Journal of Economic Perspectives, and the Quarterly Journal of Economics. He is currently a fellow of the American Academy of Arts and Sciences, a former research associate at the National Bureau of Economic Research, and a member of the Federal Reserve Bank of New York’s Financial Advisory Roundtable. From February-July of 2009, he served in the Obama Administration as a senior advisor to the Treasury Secretary and on the staff of the National Economic Council.

Sources of information for Jeremy C. Stein

http://www.federalreserve.gov/aboutthefed/bios/board/stein.htm

http://scholar.harvard.edu/files/stein/files/stein-vita-december_2011_0.pdf

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Board of Governors of the Federal Reserve System website

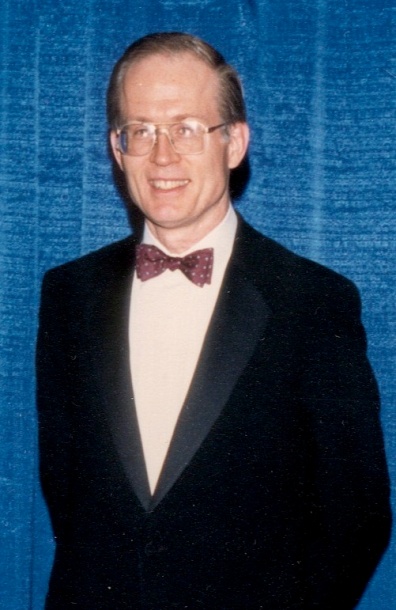

Kenneth French obtained a B.S. in 1975 from Lehigh University in mechanical engineering. At the University of Rochester, he earned an MBA in 1978, an M.S. in finance in 1981, and a Ph.D. in finance in 1983.

Currently, he is the Roth Family Distinguished Professor of Finance at the Tuck School of Business at Dartmouth College. Prior to joining Dartmouth in 2001, Professor French was on the faculty of the Massachusetts Institute of Technology’s Sloan School of Management, the Yale School of Management, and the University of Chicago’s Booth School of Business.

Professor French is an authority on the behavior of security prices and investment strategies. He and co-author Eugene F. Fama researched the value effect and the three-factor model, and were included in articles such as “The Cross-Section of Expected Stock Returns” and “Common Risk Factors in the Returns on Stocks and Bonds.” His current research focuses on tests of asset pricing, the tradeoff between risk and return in domestic and international financial markets, and the relation between capital structure and firm value.

Drs. French and Fama wrote a series of papers that questioned the validity of the Capital Asset Pricing Model (CAPM). These papers describe two factors above and beyond a stock’s market beta, which can explain differences in stock returns: market capitalization and value. They also offer supportive evidence that a variety of patterns in average returns, often labeled as “anomalies” in past work, can be explained with their Fama-French three-factor model. Dr. French has written articles for prominent academic journals, including the Journal of Finance, the Journal of Financial Economics, Review of Financial Studies, American Economic Review, the Journal of Political Economy, and the Journal of Business. Among other accomplishments, Professor French was the vice president of the American Finance Association in 2005 as well as a Rochester Distinguished Scholar. In 2007, he became a fellow to the American Academy of Arts and Sciences.

Currently, Dr. French is a research associate at the National Bureau of Economic Research, as well as an advisory editor of the Journal of Financial Economics. He is a fellow of the American Finance Association and the American Academy of Arts and Sciences, and a director at Dimensional Fund Advisors, where he also works as a consultant and head of investment.

Sources of information for Kenneth R. French

http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/index.html

http://en.wikipedia.org/wiki/Kenneth_French

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Dartmouth Tuck School of Business website

Richard Green (1953-2015) obtained his B.A. in English from Pomona College in 1976. In 1979, he obtained his M.S. in business administration from the University of Wisconsin-Madison. In 1982, he received his Ph.D. in finance, also from the University of Wisconsin-Madison.

From 1990 to 1999, Dr. Green served as a professor of financial economics at Carnegie Mellon University’s Graduate School of Industrial Administration. From 1999-2015, Dr. Green was the Richard M. and Margaret S. Cyert Professor of Economics and Management. He also served as senior associate dean at Carnegie as a visiting professor at the Stockholm School of Economics and the University of British Columbia.

Professor Green’s research interests were in the areas of taxation and asset pricing. He has been an editor and associate editor of several prominent journals, including the Journal of Financial Economics, the Journal of Finance, Review of Financial Studies, Management Science, and the Journal of Financial and Quantitative Analysis.

Dr. Green has numerous professional affiliations. He has served as president for the Western Finance Association from 1999-2000. He also served as vice president of the Society for Financial Studies from 1997-1999. In 2011, Dr. Green was appointed as a research associate to the National Bureau of Economic Research. He was also a fellow at TIAA-CREF from 2005-2010.

In 1995, he received the award for C.G.S. Teaching Excellence Award, University of British Columbia in 1995. He also was the recipient of the George Leland Bach Teaching Award, GSIA in 1996.

Sources of information for Richard C. Green

http://www.nber.org/people/richard_green

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Carnegie Mellon Tepper School of Business website

John Campbell received a B.A. from Oxford University in 1979. He then earned his Ph.D. from Yale University in 1984. Dr. Campbell holds honorary doctorates from the University of Maastricht and the University of Paris Dauphin. Following graduation, he spent the next ten years teaching at Princeton, before accepting a teaching position at Harvard University in 1994. At Harvard, Dr. Campbell helped to oversee the investment of the endowment as a board member of the Harvard Management Company, while also serving as chair of the Department of Economics. He is the current Morton L. and Carole S. Olshan Professor of Economics at Harvard University.

Professor Campbell has published over 80 articles in finance and economics journals. His topics of research include finance and macroeconomics, fixed-income securities, equity valuation, and portfolio choice. He is the author of The Econometrics of Financial Markets (with Andrew Lo and Craig MacKinlay), Strategic Asset Allocation: Portfolio Choice for Long-Term Investors (with Luis Viceira), and The Squam Lake Report: Fixing the Financial System (with the Squam Lake Group of financial economists). In 2005, he received the Graham and Dodd Award for his Financial Analysts Journal paper with Luis Viceira entitled “The Term Structure of the Risk-Return Tradeoff.”

Dr. Campbell is currently a Fellow of the American Academy of Arts and Sciences. He is also a research associate and former director of the Program in Asset Pricing at the National Bureau of Economic Research. He is a fellow of the Econometric Society and the American Academy of Arts and Sciences, and a corresponding fellow of the British Academy and Honorary Fellow of Corpus Christi College, Oxford.

Dr. Campbell was a consultant for PanAgora Asset Management prior to assisting with the founding of Arrowstreet Capital, LP. He currently holds a seat on the firm’s Investment Committee. He has also directed the Asset Pricing program at the National Bureau of Economic Research.

Sources of information for John Y. Campbell

http://scholar.harvard.edu/campbell/biocv

http://en.wikipedia.org/wiki/John_Y._Campbell

http://scholar.harvard.edu/campbell/home

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the European Finance Association website

René Stulz received his doctorate from the Massachusetts Institute of Technology. He was awarded a Marvin Bower Fellowship from the Harvard Business School, a Doctorat Honoris Causa from the University of Neuchâtel, and the Risk Manager Award of the Global Association of Risk Professionals.

Professor Stulz has served as the Everett D. Reese Chair of Banking and Monetary Economics and the director of the Dice Center for Research in Financial Economics at the Ohio State University since 1996. Prior to that, he taught at the Massachusetts Institute of Technology, the University of Chicago, and the University of Rochester.

Dr. Stulz has served as editor of the Journal of Finance, the leading academic publication in the field of finance, for 12 years. He has published more than 60 papers in finance and economics journals. He is on the editorial board of more than 10 academic and practitioner journals. Professor Stulz’s research interests span a wide range of topics, including corporate finance, mergers and acquisitions, cost of capital, financial institutions, derivatives, international finance, risk management, valuation, and investments.

Dr. Stulz is a director of Banque Bonhote, the president of the Gamma Foundation, and a trustee of the Global Association of Risk Professionals. He is a member of the Asset Pricing and Corporate Finance Programs and the director of the Risk of Financial Institutions Group of the National Bureau of Economic Research. He is also currently a fellow of the American Finance Association, the Financial Management Association, and the European Corporate Governance Institute.

Professor Stulz has taught executive development programs in the United States, Europe, and Asia. He has consulted for major corporations, law firms, the New York Stock Exchange, the International Monetary Fund, and the World Bank. Dr. Stulz has served as president of the Western Finance Association in 2004. In 2004, Treasury and Risk Management magazine named him one of the 100 most influential people in finance.

Sources of information for René M. Stulz

http://fisher.osu.edu/fin/faculty/stulz/

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from The Ohio State University Fischer College of Business website

Douglas Diamond obtained an A.B. in economics from Brown University in 1975, an M.A. in 1976, an M.Phil. in 1977, and a Ph.D. in 1980 in economics, all from Yale University. During his graduate training, he had secured a position with the Board of Governors of the Federal Reserve System.

Dr. Diamond is currently the Merton H. Miller Distinguished Service Professor of Finance and Neubauer Family Faculty Fellow at The University of Chicago’s Booth School of Business. He has been affiliated with the Booth School since 1979 and is currently the co-director of the Fama-Miller Center for research in finance. He has previously taught at Yale University, Hong Kong University of Science and Technology, as well as the University of Bonn.

Professor Diamond is considered to be a pioneer for his work in finance, which has changed the way certain aspects of the financial system are viewed. He specializes in the study of financial intermediaries, financial crises, and liquidity. His most influential early research includes “Financial Intermediation and Delegated Monitoring,” in the Review of Economic Studies and “Bank Runs, Deposit Insurance, and Liquidity,” in the Journal of Political Economy, authored with Philip H. Dybvig. Professor Diamond’s work has appeared in various journals, including the Journal of Financial Economics, the Journal of Finance, Review of Economic Studies, American Economic Review, and the Journal of Political Economy.

Dr. Diamond is currently a visiting scholar at the Federal Reserve Bank of Richmond, a position that he has held since 1990. He is also a research associate for the National Bureau of Economic Research. In addition, he is on the board of directors of the Center for Research in Security Prices. Dr. Diamond is also a fellow of the Econometric Society, the American Academy of Arts and Sciences, and the American Finance Association.

Dr. Diamond is a former president of the Western Finance Association. At one point, he was the recipient for the Morgan Stanley American Finance Association Award for Excellence in Finance. The award is given for recognition of an individual’s career achievements and leadership in financial economics research.

Sources of information for Douglas W. Diamond

http://www.chicagobooth.edu/faculty/directory/d/douglas-w-diamond

http://news.uchicago.edu/article/2012/01/09/douglas-diamond-wins-morgan-stanley-afa-award-financial-economics-research

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Chicago Booth News website

Maureen Patricia O’Hara (2002)

Maureen O’Hara received a B.S. in economics from the University of Illinois in 1975. She then obtained an M.S. in economics and a Ph.D. in finance, both from Northwestern University, in 1976 and 1979, respectively. Dr. O’Hara is the recipient of honorary doctorates from Facultés Universitaires Catholiques à Mons, Belgium, and Universität Bern, Switzerland.

In 1979, Dr. O’Hara joined the faculty at the Johnson Graduate School of Management at Cornell University. She is currently the Robert W. Purcell Professor of Finance there. Professor O’Hara’s primary research interests focus on market microstructure. She is the author of numerous journal articles as well as the book Market Microstructure Theory (Blackwell: 1995). Dr. O’Hara has publishes on a broad range of topics that include banking and financial intermediaries, law and finance, and experimental economics. She has also served as an editor of numerous publications.

Dr. O’Hara is currently chairman of the board of directors of Investment Technology Group, Inc. and serves on the board of directors of NewStar Financial, where she is on the audit and governance committees. She also serves on the board of trustees of Teachers Insurance and Annuity Association (TIAA-CREF). Dr. O’Hara is a member of the CFTC-SEC Emerging Regulatory Issues Task Force, the Global Advisory Board of the Securities Exchange Board of India (SEBI), and the Advisory Board of the Office of Financial Research, United States Treasury. She has consulted for a number of companies and organizations, including Microsoft, Merrill Lynch, Credit Suisse, the New York Stock Exchange, Bristol-Meyers Squibb, and the World Federation of Exchanges. Dr. O’Hara has also served as president of the Western Finance Association, the Financial Management Association, the Society for Financial Studies, and the International Atlantic Economic Society.

Sources of information for Maureen P. O’Hara

http://www.johnson.cornell.edu/faculty/profiles/ohara/

http://web.law.columbia.edu/capital-markets/program-fellows/maureen-ohara

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Systemic Risk Council website

George M. Constantinides (2001)

George Constantinides earned a B.A. in physics, and then later an M.A., both from Oxford University. He later came to the United States in 1970 on a Fulbright travel scholarship to pursue further graduate studies. In 1972, he received an MBA, and then a Ph.D. in business management in 1975, both from Indiana University. He was also a Marvin Bower Fellow from 1985-1986 at Harvard University.

Professor Constantinides joined the Chicago Booth School of Business faculty in 1979, having previously taught at Carnegie Mellon University for five years. At the Booth School, he was named the Leo Melamed Professor of Finance. His research interests include the causes of the historically observed premium of equity returns over bond returns, the pricing and hedging of fixed-income securities, options, futures, and other derivatives, the effects of transaction costs and taxes on the pricing and hedging of derivatives, and portfolio management.

Dr. Constantinides has published numerous papers in distinguished academic periodicals. Several noteworthy articles include the following: “Mispricing of S&P 500 Index Options,” written with J. C. Jackwerth and S. Perrakis in the Review of Financial Studies; Rational Asset Prices, in the Journal of Finance; and “Junior Can’t Borrow: A New Perspective on the Equity Premium Puzzle,” written with J. B. Donaldson and R. Mehra in the Quarterly Journal of Economics.

Dr. Constantinides is currently a research associate at the National Bureau of Economic Research and serves as a director and trustee of the Dimensional Fund Advisors’ family of funds and trusts. He has held numerous prior professional affiliations throughout this career. Some of these include former president of the Society for Financial Studies, director of the Western Finance Association, editor-in-chief of Foundations and Trends in Finance, and advisory editor for the World Scientific Handbook in Financial Economics Series.

Sources of information for George M. Constantinides

http://www.chicagobooth.edu/faculty/bio.aspx?person_id=12824690688

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Chicago Booth School of Business website

Frank Allen received his B.A. in economics and computing studies in 1977 from the University of East Anglia. He received an M.A. in economics in 1979, and then completed his doctorate in 1980, both from the University of Oxford. Some of his visiting teaching appointments have included the Universities of Oxford, Tokyo, and Frankfurt; Princeton University; and an adjunct appointment at New York University.

Dr. Allen has been a professor at the Wharton School of the University of Pennsylvania since 1980. In 1994, he was named the Nippon Life Professor of Finance and Economics at the Wharton School of Business. He has won many Wharton teaching awards throughout his academic career. He has held the position of co-director of Financial Institutions Center at Wharton since 2000.

Professor Allen’s research interests over the years have included corporate finance, asset pricing, and the economics of information. Throughout his career, he has maintained a lengthy list of publications. He was also co-author of the widely known finance textbook Principles of Corporate Finance.

Dr. Allen has held the position of Associate Editor of Financial Management since 1991; managing editor of the Review of Finance since 2012; advisory editor of the Journal of Financial Markets, Journal of Financial Services Research, and Journal of Financial Stability. He has also served as the director of The Glenmede Fund since 1991. Other previously held positions have included vice-dean and director of Doctoral Programs at Wharton (1990-93) and associate director of Doctoral Programs at Wharton (1988-90). He has served as an editor for several of the world’s top academic journals for both finance and economics. He currently serves as an advisor to Fair Observer, an online magazine on global issues of finance, economics, future strategy, and editorial policy.

Sources of information for Franklin Allen

http://www.fairobserver.com/profile/fallen

https://fnce.wharton.upenn.edu/profile/903/

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Wharton Global Alumni Forum website

Hans Stoll received his A.B. in economics in 1961 from Swarthmore College, his MBA in 1963 and his Ph.D. in 1966, both from the University of Chicago. Prior to accepting a faculty position at Vanderbilt University in 1980, he had taught at the Wharton School of the University of Pennsylvania since 1966. Dr. Stoll has also been a visiting professor at the Board of Governors of the Federal Reserve System from 1968-1969, and he served on the staff of the Institutional Investor Study of the Securities and Exchange Commission from 1969-1970. From 1976-1977, he was a Senior Fulbright-Hays visiting lecturer at ESSEC in Paris, France. He also was a visiting professor at the University of Chicago (1975-1976), at the University of Karlsruhe (1986), and at the University of British Columbia (July, 1990). In 2007, he received an honorary doctorate degree from Goethe University, Frankfurt, Germany.

Dr. Stoll is currently the Anne Marie and Thomas B. Walker, Jr., Professor of Finance, Emeritus, and Director of the Financial Markets Research Center at the Owen Graduate School of Management at Vanderbilt University. Throughout his career, he has published several books and more than 60 articles on subjects ranging from the forward foreign exchange market, options, commodity futures, small business financing, regulation of securities markets, stock market structure and volatility, and many other topics. Professor Stoll is well known for developing and testing the put-call parity relation for option prices, for modeling and testing the behavior of securities markets dealers, for his work on program trading and the “triple witching hour,” and for his work on the sources and components of the bid-ask spread.

In 1996, Dr. Stoll received the Earl Sutherland Prize, which is awarded to individuals for outstanding research across all fields at Vanderbilt University. He has also served as president of the Western Finance Association, and associate editor of the Journal of Finance and the Journal of Financial Economics. Dr. Stoll has been a director of the American Finance Association, the Financial Management Association, and the Institute for the Study of Security Markets. He is currently an advisory editor of the Journal of Financial Markets and the Multinational Finance Journal. He is also an associate editor of the Journal of Financial and Quantitative Analysis, the Journal of Derivatives, and Financial Management.

Sources of information for Hans R. Stoll

https://www.owen.vanderbilt.edu/faculty-and-research/faculty-directory/faculty-profile.cfm?id=137

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Vanderbilt University Owen Graduate School of Management website

Edwin Elton completed his undergraduate work in 1965 at Carnegie Mellon University. He then completed an M.S. and a Ph.D. in industrial administration, 1965 and 1971 respectively, also at Carnegie. Dr. Elton is currently the Nomura Professor of Finance at the Stern School of Business of New York University. Dr. Elton is also a fellow of the American Finance Association and the Institute for Quantitative Analysis.

Throughout his career, Professor Elton has authored or co-authored eight books and more than 110 articles. The eighth edition of his book, Modern Portfolio Theory and Investment Analysis, is the standard textbook used in most leading graduate schools of business. His articles have appeared in the Journal of Finance, Review of Financial Studies, Review of Economics and Statistics, Management Science, the Journal of Financial Economics, the Journal of Business, Oxford Economic Papers, and the Journal of Financial and Quantitative Analysis. His collected works in investments are published in three volumes: two by MIT Press, and one by World Scientific.

Dr. Elton has served as co-editor of the Journal of Finance, and an associate editor of Management Science. Professor Elton has served as a portfolio theory and investment management consultant for many major financial institutions in Asia, Europe, and the United States. He was a senior research fellow at the International Institute of Management in Berlin, and a visiting scholar at the European Institute for Advanced Studies in Management (EIASM) in Brussels and at Katholieke Universiteit Leuven.

Professor Elton is a recipient of the distinguished research award by the Eastern Finance Association. He is also a recipient of the Graham Dodd award for research in investments and the James Vertin Lifetime Achievement Award from the Financial Analyst Federation. In addition, Dr. Elton was also named Distinguished Scholar by the Eastern Finance Association.

Sources of information for Edwin J. Elton

http://pages.stern.nyu.edu/~eelton/

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the New York University Stern School of Business website

Hayne Ellis Leland received his bachelor’s degree in economics from Harvard University. He obtained a master’s degree at the London school of Economics, and then returned to Harvard to complete his Ph.D. Upon completion of his doctorate, Dr. Leland worked as an assistant professor at Stanford University from 1968 to 1974.

Dr. Leland is currently the Arno Rayner Professor Emeritus of Finance and Management at The University of California Berkeley’s Haas School of Business. He has been affiliated with the university since 1974. From 1991 – 2001, he served as the director of the Berkeley Program in Finance.

Professor Leland has published articles on investment theory, optimal portfolio choice, and dynamic hedging. Current research interest include structural modeling of credit risk, dynamic models of optimal leverage and agency costs, optimal investment strategies in the presence of transaction costs, and performance measurement: beyond mean-variance analysis. Recent work has focused on credit risk, optimal financing, and risk management by corporations. His research has received numerous prizes for excellence, and he has given keynote speeches at the American Finance Association and the Financial Management Association.

Dr. Leland has won numerous awards throughout his career. In 2008, he won the Stephen A. Ross Prize in Financial Economics, which is awarded to a significant paper in finance published in the last 15 years. Also in 2008, Professor Leland was awarded the Lifetime Achievement Award by the Financial Intermediation Research Society. Additional honors include being named “Businessman of the Year” by Fortune Magazine in 1987, winning the Graham and Dodd Award in 1999, and winning the Roger Murray Prize in 1997. More recently, Dr. Leland became the first recipient of the Stephen A. Ross Prize from the Foundation for the Advancement of Research in Financial Economics (FARFE) for his research in corporate debt pricing and capital structure.

Sources of information for Hayne E. Leland

http://facultybio.haas.berkeley.edu/faculty-list/leland-hayne

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the University of California Haas School of Business website

Eduardo Schwartz received a B.Eng in industrial engineering from the University of Chile in 1963, and then completed a M.Sc. in business administration and a doctorate degree in finance from the University of British Columbia in 1973 and 1975, respectively. He has served on the faculty at the University of British Columbia and was a visiting professor at the London Business School and the University of California at Berkeley. Professor Schwartz was a recipient of a Doctor Honoris Causa by the University of Alicante in Spain and by the Copenhagen Business School as well.

Dr. Schwartz is currently the California Professor of Real Estate and Professor of Finance at the Anderson Graduate School of Management at the University of California Los Angeles. His recent research interests include pricing internet companies, interest rate models, asset allocation issues, evaluating natural resource investments, the stochastic behavior of commodity prices and valuing patent-protected research and development projects. He has written more than 80 articles, two monographs, and numerous chapters and special reports on assets and securities pricing. He has served as an associate editor for the Journal of Finance, the Journal of Financial Economics, the Journal of Financial and Quantitative Analysis, and many others.

Professor Schwartz is well known for his pioneering research in the area of derivatives. He is one of the first researchers to develop the real options method of pricing investments under uncertainty. Additional significant contributions to the field include the Longstaff-Schwartz model, the Longstaff-Schwartz method for evaluation options by Monte Carlo Simulation, and the use of Finite difference methods for option pricing. He is also co-editor, with Lenos Trigeorgis, on the book Real Options and Investment Under Uncertainty, which is a compilation of recent papers and classic research in the field.

Dr. Schwartz is past president of the Western Finance Association. He is also a fellow of the American Finance Association and the Financial Management Association International, as well as a research associate for the National Bureau of Economic Research. In 2000, he received the Graham and Dodd Award for his paper, “Rational Pricing of Internet Companies,” published in the Financial Analysts Journal. Dr. Schwartz has served as a consultant to numerous governmental agencies, banks, investment banks and industrial corporations.

Sources of information for Eduardo S. Schwartz

http://www.anderson.ucla.edu/faculty/finance/faculty/schwartz

http://en.wikipedia.org/wiki/Eduardo_Schwartz

http://www.nber.org/vitae/vita667.htm

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Norwegian School of Economics website

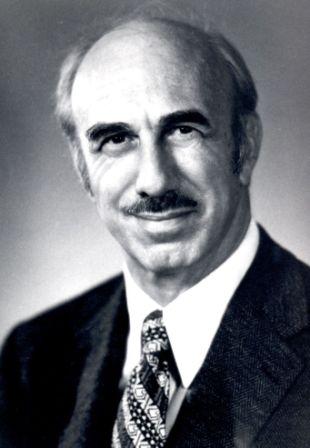

Martin Gruber received an S.B. in chemical engineering from the Massachusetts Institute of Technology in 1959. He then went on to obtain an MBA in production management in 1961, and a Ph.D. in financial economics in 1966, both at Columbia University. He also was awarded the degree of Docteur “honoris causa” by the University of Liege, Belgium. In 1965, Professor Gruber joined the Leonard N. Stern School of Business of New York University, and has been a Nomura Professor of Finance there since 1987. He is currently Professor Emeritus and Scholar in Residence there as well.

Dr. Gruber is the current director, a member of the executive committee, and a member of the investment committee for the National Bureau of Economic Research. He is a fellow of the American Finance Association, the Financial Management Association, and the Institute for Quantitative Research in Finance. Beginning in 1995, he had served as Finance Department Chairman at New York University for nine years.

Dr. Gruber’s current research interests include portfolio theory and management, mutual funds structure and performance, and pension funds. The ninth edition of his book, Modern Portfolio Theory and Investment Analysis, is one of the leading texts in graduate schools of business. In addition, he has published six other books in investment analysis and portfolio management. Professor Gruber has written over 100 articles which have appeared in the Journal of Finance, Review of Economics and Statistics, the Journal of Financial Economics, the Journal of Business, Management Science, the Journal of Financial and Quantitative Analysis, Operations Research, Oxford Economic Papers and the Journal of Portfolio Management.

Professor Gruber was named a distinguished scholar by the Eastern Finance Association, and has received the Graham and Dodd Award for research in investments. In 2004, he was awarded the James R. Vertin Award by AIMR in recognition of his research notable for its relevance and enduring quality to investment professionals.

Sources of information for Martin J. Gruber

http://pages.stern.nyu.edu/~mgruber/

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the New York University Stern website

Sanford Grossman received a B.A., with honors, in economics from the University of Chicago in June 1973. He then continued his studies at the U of C to earn an A.M. in economics 1974 and a Ph.D. in 1975. Since receiving his doctorate, he has held academic appointments at Stanford University; the University of Chicago; Princeton University, as the John L. Weinberg Professor of Economics, 1985–1989; and at the University of Pennsylvania’s Wharton School of Business. At Wharton, he held the position of Steinberg Trustee Professor of Finance from 1989 to 1999 (a title now held in emeritus status) and also served as the director of the Wharton Center for Quantitative Finance from 1994 to 1999.

An American economist and hedge fund manager, Professor Grossman is considered an expert on corporate structure, property rights, risk management, and securities markets. He has published widely in leading economic and business journals, including American Economic Review, Journal of Econometrics, Econometrica, and the Journal of Finance. In addition, his research in macroeconomics, finance, and risk management has earned him numerous awards. For example, in 1987, he was awarded the John Bates Clark Medal, given by the American Economic Association, to recognize the nation’s most outstanding economist under the age of 40. In 2002, he received the Universities Professional Achievement Citation. He was also awarded the Roger F. Murray Prize in 1988.

Dr. Grossman is currently chairman and chief executive officer at Quantitative Financial Strategies and Grossman Asset Management, a hedge fund he founded in 1988 to develop investment models based on his research. It is an alternative investment management firm that uses financial investment models based on Grossman’s research in economics and quantitative finance. Previously, Dr. Grossman served as an economist with the Board of Governors of the Federal Reserve System (1977–1978); and was a public director of the largest United States options and futures exchange, the Chicago Board of Trade (1992–1996).

Sources of information for Sanford J. Grossman

http://www.nber.org/vitae/vita242.htm

http://ideas.repec.org/e/pgr108.html

http://en.wikipedia.org/wiki/Sanford_J._Grossman

http://www.nndb.com/people/055/000169545/

http://alumniandfriends.uchicago.edu/site/c.mjJXJ7MLIsE/b.4700047/k.9BFD/Sanford_Grossman.htm

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the Opzioni Binarie website

Mark Rubinstein holds an A.B. in economics from Harvard University, an MBA in finance from Stanford University, and a Ph.D. in finance from the University of California, Los Angeles. Professor Rubinstein has been associated with the Haas School of Business at the University of California at Berkeley since 1972 where he is currently a Professor Emeritus.

Professor Rubinstein is known for his work on the binomial options pricing model, also known as the Cox-Ross-Rubinstein model, as well as his early work on asset pricing in the 1970s. Along with fellow Berkeley finance professor Hayne E. Leland, Dr. Rubinstein developed the portfolio insurance financial product in 1976. He also coined the term “exotic options” with Eric Reiner. His current research interests include the history of the theory of investments as well as Christianity. His books publications include Options Markets and Rubinstein on Derivatives. Dr. Rubenstein is the author of more than 50 publications in leading finance and economic journals, and he is currently an associate editor for eight academic journals.

Dr. Rubenstein’s papers are often reprinted in survey publications. He has won numerous prizes and awards for his research and writing on derivatives, including International Financial Engineer of the Year for 1995. He also won the Graham and Dodd award in 2002 for the best article published during the year 2001 (on the rationality or efficiency of financial markets) in the Financial Analysts Journal. Out of all of his awards, he maintains that he is most proud of winning the in 2003 the Best Teacher Award in the new Masters of Financial Engineering Program at Berkeley.

In addition to teaching and research, Dr. Rubenstein has held several administrative positions throughout his career. He has served as the director for the SuperShare Services Corporation, as well as founding principle and executive vice-president of Leland O’Brien Rubinstein Associates. He was on the advisory board of the Journal of Investment Management.

Sources of information for Mark E. Rubenstein

http://www.iafe.org/html/MRubenstein.php

http://en.wikipedia.org/wiki/Mark_Rubinstein

http://facultybio.haas.berkeley.edu/faculty-list/rubinstein-mark

http://en.wikipedia.org/wiki/American_Finance_Association

Photograph from the University of California Berkley Haas School of Business website

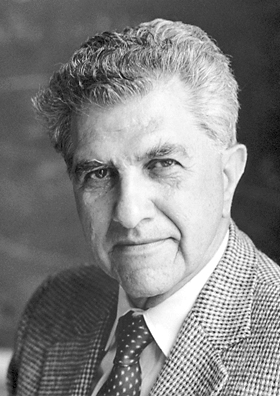

Michael Jensen earned his A.B. from Macalester College, his MBA in finance and his Ph.D. in economics, finance, and accounting, all from the University of Chicago. He has been awarded numerous honorary Doctor of Law degrees from universities around the world. He was the LaClare Professor of Finance and Business Administration at the William E. Simon Graduate School of Business Administration at the University of Rochester from 1984-1988. Professor Jensen, currently the Jesse Isidor Straus Professor of Business Administration, Emeritus, was hired as part of the faculty of the Harvard Business School in 1985.

Professor Jensen is the author of over 100 scientific papers, in addition to many articles, comments, and editorials published on a wide range of economic, finance and business-related topics. He is well known for his 1976 paper, co-authored with William H. Meckling, “Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure.” He co-authored a book with Kevin Murphy and Eric Wruck, CEO Pay and What to Do About It: Restoring Integrity to Both Executive Compensation and Capital-Market Relations. In 1973, Professor Jensen co-founded, with Eugene Fama and Robert Merton, the Journal of Financial Economics, and served as its managing editor from 1987 to 1997, when he became founding editor.

Dr. Jensen co-founded Social Science Electronic Publishing, Inc. and is currently its chairman. He has served as consultant and board member to various corporations, foundations and governmental agencies, and has given expert testimony before congressional and state committees and state and federal courts. He currently serves on the Advisory Boards of ESADE Business School and the Gruter Institute for Law and Behavioral Research. He was president of the Western Economic Association International.

Dr. Jensen was named “Distinguished Scholar of the Year” in 1990 by the Eastern Finance Association, and “Year’s 25 Most Fascinating Business People” by Fortune Magazine. In 2009, he was awarded the Lifetime Achievement Award for Contributions to Research in the Field of Financial Intermediation by the Financial Intermediation Society. In 2004, Dr. Jensen received the Tjalling C. Koopmans EFACT Conference Award for “extraordinary contributions to the economic sciences, and to have reached the highest standards of quality of research.” His paper “The Agency Cost of Overvalued Equity and the Current State of Corporate Finance” received the European Financial Management 2004 Readers Choice Best Paper Award. Dr. Jensen founded what is currently the Negotiations, Organizations and Markets Unit at Harvard. He is also currently the managing director of organization strategy at Monitoring Group, a strategy consulting group. Dr. Jensen founded the Managerial Economics Research Center at the University of Rochester in 1977 and served as its director until 1988.

Sources of information for Michael C. Jensen

http://drfd.hbs.edu/fit/public/facultyInfo.do?facInfo=bio&facId=6484

http://www.people.hbs.edu/mjensen/pub1.html

http://ideas.repec.org/e/pje57.html

http://en.wikipedia.org/wiki/Michael_Jensen

http://en.wikipedia.org/wiki/American_Finance_Association

http://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=9

Photograph from the Harvard Business School website

Robert Litzenberger received his B.A. from Wagner College in 1964. He then completed his Ph.D. at the University of North Carolina, Chapel Hill. Following the completion of his doctorate, he began his academic career at Carnegie-Mellon University. The following year, he joined the faculty of the Graduate School of Business at Stanford University where he eventually became C.O.G. Miller Distinguished Professor of Finance. In 1986, Dr. Litzenberg was hired as a faculty member of the Wharton School at the University of Pennsylvania as the Edward Hopkinson Professor of Investment Banking. He is currently professor emeritus at the University of Pennsylvania’s Wharton School of Business. At one point during his tenure there, he established a course in financial engineering.

Professor Litzenberger is a co-author of Foundations of Financial Economics and he has published more than 50 articles in the leading academic finance journals, many of which were co-authored with former students. Additional accolades include the following: a fellow and director of the organization; president and director of the Western Finance Association; and serving on the editorial boards of the Journal of Financial Economics, the Journal of Finance and the Journal of Financial Quantitative Analysis.

In 1995, Dr. Litzenberger joined Goldman Sachs as director of Derivative Research and Quantitative Modeling in the Fixed Income Division. Three years later, he became their firm-wide risk manager. He became a partner in 1999 and retired from an active role in 2001. In 2003, Dr. Litzenberger joined the Risk Hall of Fame and also was named the Risk Manager of the Year by Risk magazine in 2001. From 2002 to 2007, he served as an executive director of Azimuth Trust. In 2012, he was named the IAFE/SunGuard Financial Engineer of the year. Dr. Litzenberger is currently working as a consultant and board member for RGM Advisors by advising the firm on developing new trading strategies and risk management.

Sources of information for Robert H. Litzenberger

http://financialsystems.sungard.com/newsroom/newsreleases/2012/capitalmarkets122112